are nursing home expenses tax deductible in canada

Ad Answer Simple Questions About Your Life And We Do The Rest. On the line below line 33099 enter the lesser of the following amounts.

Are Retirement Home Expenses Tax Deductible In Canada Ictsd Org

Requires supervision due to a cognitive impairment such as.

. No Tax Knowledge Needed. The Teacher and Early Childhood Educator School Supply tax credit is a refundable tax credit. You can claim the disability amount together with the portion of the.

A 50 annual deductible is applied to the total of all eligible health benefit expenses incurred in a benefit year except for prescription drugs and diabetes supplies. Group homes in Canada. Cannot perform at least two activities of daily living such as eating toileting transferring bath dressing or continence.

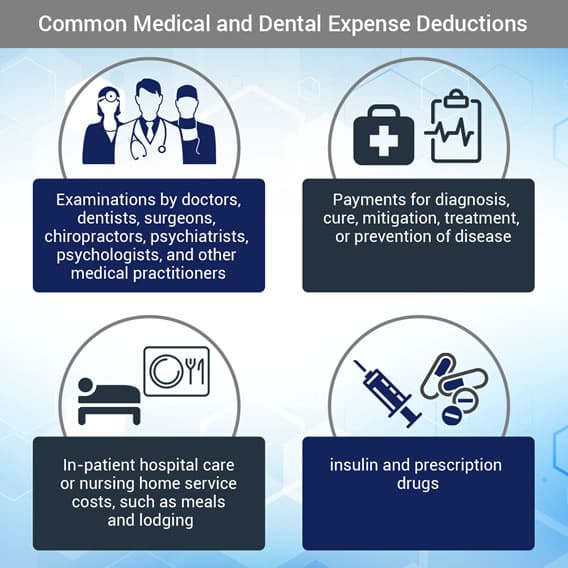

Teacher and early childhood educator school supply tax credit. Nursing homes special rules apply to this type of facility. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill This means a doctor or nurse has certified that the resident either.

Depreciation Owned If you own your business vehicle you can deduct the costvalue of your car over a 5 year period through depreciation. There are a few different ways. When no claim has been made for health benefits in a benefit year any such expenses incurred during April May or June that do not exceed 50 may be carried forward.

If you claim the fees paid to a nursing home for full-time care as a medical expense on line 33099 or 33199 of your tax return Step 5 Federal tax no one including yourself can claim the disability amount for the same person. TurboTax Makes It Easy To Get Your Taxes Done Right. File With Confidence Today.

On line 33099 of your tax return Step 5 Federal Tax enter the total amount that you or your spouse or common-law partner paid in 2021 for eligible medical expenses. Line 33099 Step 1. Subtract the amount of step 2 from the amount on line 33099 and enter the.

Depreciation Owned If you own your business vehicle you can deduct the costvalue of your car over a 5. Attendant care and nursing home expenses. The benefit year runs from July 1 to June 30.

3 of your net income or. Traditionally this credit allowed an employee who is a teacher or early childhood educator to claim a 15 refundable tax credit on up to.

Are Medical Expenses Tax Deductible

How To Deduct Your Swimming Pool And Other Home Improvements As Medical Expenses All Legal If You Do It Right Engage Advisors

What To Know About Deductible Medical Expenses E File Com

Imgur The Most Awesome Images On The Internet Flow Chart Finance Advice Personal Finance Advice

What Are Tax Deductible Medical Expenses The Turbotax Blog

What Medical Expenses Can I Claim On My Taxes In Canada

Are Assisted Living Expenses Tax Deductible In Canada Ictsd Org

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

What Are Tax Deductible Medical Expenses The Turbotax Blog

Private Home Care Services May Be Tax Deductible

Can You Claim Nursing Home Expenses On Taxes In Canada Ictsd Org

Irs Publication 502 Medical Expense What Can Be Deducted Tax Free Core Documents

What Tax Deductions Are Available For Assisted Living Expenses

Medical Expenses What It Takes To Qualify For A Tax Deduction Insight Accounting

What To Know About Deductible Medical Expenses E File Com

Sample Of Excel Spreadsheet Excel Spreadsheets Excel Templates Excel For Beginners

Give To Charity But Don T Count On A Tax Deduction

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips